Advancing Time

Sunday, May 5, 2024

Advancing Time: Chinese EVs are piling up and blocking European Ports

Chinese EVs are piling up and blocking European Ports

The mania over replacing fossil fuel powered cars with electric vehicles is beginning to wane. Several news agencies have reported that masses of unsold Chinese EVs are piling up and blocking European Ports. Interestingly the timing of this coincides with an announcement by Tesla that sparked another rally in its stock. Following a weekend visit to China Elon Musk reports that the company will partner with Baidu (BIDU) on mapping data collection.

The news China has approved Tesla's program intersects with China's push into the EV market as its housing market explodes. In short, China needs a new spark or something to kick-start its economy. With enthusiasm for EVs on the wane, approving Tesla's program may be another propaganda campaign to tie EVs with the image, and idea, it will lead to an idyllic future. The Chinese EV sector wants and needs the "Tesla development" to generate the sign that the U.S. and China can work together in the EV space.

Automobile manufacturing is a huge market and the Chinese have made a huge investment in the EV sector by subsidizing its growth. In doing so they have set in motion the machinery to destroy auto manufacturers in other countries and thus dominate global auto production. Diminishing demand in China for their products is a huge contributor to Europe's top two car manufacturers' downturn which the Financial Times reported recently.

Not only has China heavily subsidized its EV sector, but it has even gone to outlawing the sale of fossil fuel automobiles. It now appears China has gone down this path with the intention of taking over the world auto market. It could be argued Tesla is no more than a pawn in this strategy. Embrace China early on, then when it becomes convenient, throw it under the bus, but not yet.

In a video, The Electric Viking, delves into the issue of Chinese EVs piling up in European Ports.

It seems from the number of new auto transport ships under construction

or being planned in China this is only the start of a full-court

press. This is where it should be noted that, abusing free trade is not fair trade. China's form of capitalism is predatory. Many of the comments below the Electric Viking video indicate viewers agree something is wrong and offer several solutions to the problem.

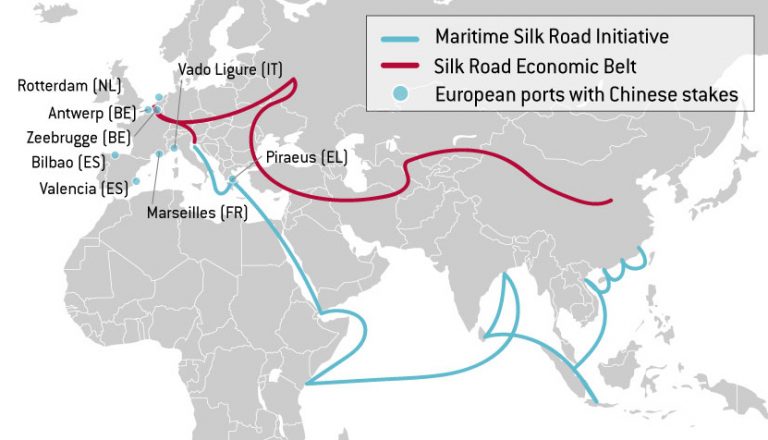

China Is Targeting Europe

As for Tesla's stock, while it has moved much higher, Ihor Dusaniwsky, managing director of predictive analytics at S3 Partners, said. “This has not been a short squeeze,” Dusaniwsky said as S3 has “actually seen short selling into this rally with over 2 million new shares shorted over the last week.” Tesla is the third largest U.S. short behind Nvidia and Microsoft, he said.

It seems that Wells Fargo analyst Colin Langan was also surprised by the

big share price move. Langan warned that there could be restrictions on

sharing data, which could limit Tesla's (TSLA) ability to leverage the

tech progress it has seen in the U.S. There is also the glaring point

that Chinese electric vehicle makers are undercutting Tesla when it

comes to pricing.

Yes, the cars China produces must go somewhere, but that does not mean into my country! Remember price is not everything and there is a hidden price embedded in these cars. That is the destruction of local jobs. Again, I'm forced to ask whether EVs are the answer to global climate issues that governments and EV proponents claim. The fact that I'm not a fan of these vehicles aside, one thing is certain and that is China is all in and plans to crush automakers across the world.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

Thursday, May 2, 2024

Advancing Time: Looking At Financial "One-Offs" Driving The Economy

Looking At Financial "One-Offs" Driving The Economy

Those of us accused of promoting doom porn and claiming history indicates markets revert to the norm have been wrong for a long time. In our defense, distortions in the markets can go on for a long time. Still, if history is any guide this time will not be different. Simply put, trees do not grow to the sky and at some point, the numbers do not work. Not all things move in a linear fashion or extend along a straight or nearly straight line, they can go parabolic, or collapse before our eyes.

Lately, many people have forgotten the lesson the economy tried to teach us in 2008. Massive intervention halted that collapse, but this is not about the Fed, it is about the economy. Looking back through history, many of the things that have impacted the economy are now viewed as "one-offs" or in some ways a one-time event with a huge impact. This is one reason many comparisons between what is and what was have now been rendered obsolete. Still, certain laws of economics should and do, over the long term remain intact.

Don't forget, that much of the financial machine runs on autopilot and not on a day-to-day basis. This means markets become complacent and tend to assume a trend will continue. After a decision is made as to how money will be invested over the next year or two investors have a way of turning their attention elsewhere. This is a key reason so much money is passively invested and discounts the long-term ramifications of reality.

Also, important is the velocity of money. This is the speed at which money moves through the economy. It is important to remember a very small percentage of rich households at the top hold much of the money cast out into the world. This is often parked in investments and does not get "spent." This might explain why the speed at which money moves through the economy has been slowing. Meanwhile, no moss grows on the money poor people get into their hands.

Liquidity and leverage also play a large role in economic growth. Leverage is often tied to loose and easy money policies. While people seem obsessed with small changes in interest rates, a far greater concern is liquidity. Without liquidity, markets can not function and true price discovery does not take place. There is a yin and yang aspect to the economy that short term can be forgotten putting investors at great risk. This centers around the opposite but interconnected self-perpetuating cycle that results from bad policies.

To get a handle on where the economy is headed investors are

generally forced to turn towards the news and the most recent data.

Sadly, incompetent bureaucrats, people with agendas, and governments

have a way of skewing data. Financial strength is different from the

illusion of growth often touted in the GDP that results from a slew of

methods to boost consumption. Below are examples of a few things

investors fail to see as the "one-offs" they are.

- Recently we have seen many new Employer Identification Numbers (EINs) being requested, this may be mistakenly seen as a sign of new business formations. In truth, many have existed for a long time and others not be viable. New regulations are driving this and it does not mean small businesses are thriving.

- In December of 2023, companies plowed over $18 billion into constructing manufacturing plants in the US ($220 billion annualized), up 64% from a year ago. This is up by 170% from December 2019. Even with government incentives, this cannot go on forever.

- A matter that has not garnered enough attention is how economic problems from China may spill over and directly impact Japan. Over the years China and Japan have become major trading partners. Japan's direct investments surged as technology used to develop China's global supply chain exploded. The current problems haunting China are likely to spill over and damage Japan's fragile recovery.

One of the most underrated drawbacks in our world full of people is that with a large population also come large problems. People have to be fed and taken care of. Cycles of population growth may generate ever more opportunities and new demand, but this is only part of a much larger economic equation. It can lead to quality not quantity being greatly underappreciated. Capital flows and factors such as brain drain due to taxation and legal protection are a big deal.

The goal of all investors should be to look out long term and not to lose a lot of capital until we get there. Capital preservation is job one while at the same time positioning ourselves to benefit during the final inning of an unending game. Considering the number of people that have made a fortune and then lost it, good luck with that.

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)

.

Wednesday, April 24, 2024

Advancing Time: The Ugly Future Of Social Security, Huge Shortfall...

The Ugly Future Of Social Security, Huge Shortfalls Ahead

Oh, what a tangled web we weave when the government gets involved. Even if I did not get that saying right, my takeoff on it has merit. A great example of a government program on its way to ruin is Social Security. What is called the unfunded "surplus reserve" is set to run out in 2033. Remember, promises can be broken or altered, and they will. Fixing this system many people refer to as a Ponzi scheme will not be easy.

The most obvious answers include removing the cap for high earners forcing them to pay more into the system. Raising the retirement age and cutting benefits. Another is to not pay what is promised to those who have saved and sacrificed over the years saying they "really don't need it." In other words, making people with savings ineligible, this is sometimes referred to as means testing.

In truth, inflation is already attacking the incomes of retirees based on how the CPI is figured, and adjustments in payouts already fall short of the real cost of living. Months ago when inflation was near its high, the website ShadowStats claimed real inflation was closer to 17.15% rather than the 8.5% that the media, the Biden administration, and the Federal Reserve claimed. This results in smaller raises and payouts for those on Social Security saving the system billions.

Having just seen the cost of caring for an aging parent, it is easy to join those saying the system to designed so that anyone with a long life is unlikely to pass much wealth along to their children. If you have money in old age, the system is geared to rip it from you. This is a brew of wealth transfer endorsed by society in the name of "the greater good."

Comments below an eight-minute video ( https://www.youtube.com/watch?v=j1Bfxxhdn6g ) detailing the most basic facts about the wall Social Security is running into indicate most viewers get it. We understand the problem that haunts the Social Security system, Still, "getting it" changes nothing, the problem still exists. Boomers are draining the system. The comments below the video note;

- As a 37-year-old with 20 years of SS taxes behind me and another 20 years ahead of me... This video makes my skin crawl.

- The SS that you contribute is actually going to the current/next generations of retirees it’s not saving for you. Yours comes from the next generation contributing.

- We're living longer, the younger generations are having fewer children, housing is less affordable, income is not increasing, and the working class is unable to build wealth. Essentially, more people will need it and less will be paying for it.

As noted above, the unfunded Social Security "surplus reserve" is set to run out in 2033, a mere nine years from now. For such a widely used program, it’s a bit surprising that people in the US have put their heads in the sand and ignored the reality that this is no small problem. Also, most people know little about how it works. This remains the case even though most of the news around this program over the past decade has been predicting it’s doomed.

In Recent Years This Part Of The Budget Has Exploded

This is why millennials and younger workers often see the money being taken from

their paychecks with the feeling they’ll never see it again. Sadly, the compact between generations to take care of each other has come under pressure for a number of reasons. The biggest two are difficult to overcome. Demographics and the idea individuals deserve a higher standard of living than necessary are coming into conflict.

Of course, the concern over where all this is headed spans all of society. The truth is ugliness awaits most boomers nearing retirement, not only have they been lied to, but they also have to deal with rigged markets, corruption, and incompetent advisors. Anyway, you look at it, many people will not retire happy. As far as Washington and our politicians sorting out this mess, when all is said and done, this will most likely become another case of, "Thank God for the last minute or nothing would ever get done."

(Republishing of this article welcomed with reference to Bruce Wilds/AdvancingTime Blog)